RESIDENCE BASED TAXATION (‘RBT’)

On March 28, 2024, the Republicans Overseas Foundation submitted a residence-based tax proposal to Heritage Foundation’s Project 2025 for potential inclusion in the next administration’s tax reform package. The proposal, titled ‘Ending the Unjust Taxation of Overseas Americans,’ provides three actionable recommendations, including the preferred legislative solution of completely severing citizenship from United States income tax policy.

Key points from the proposal include:

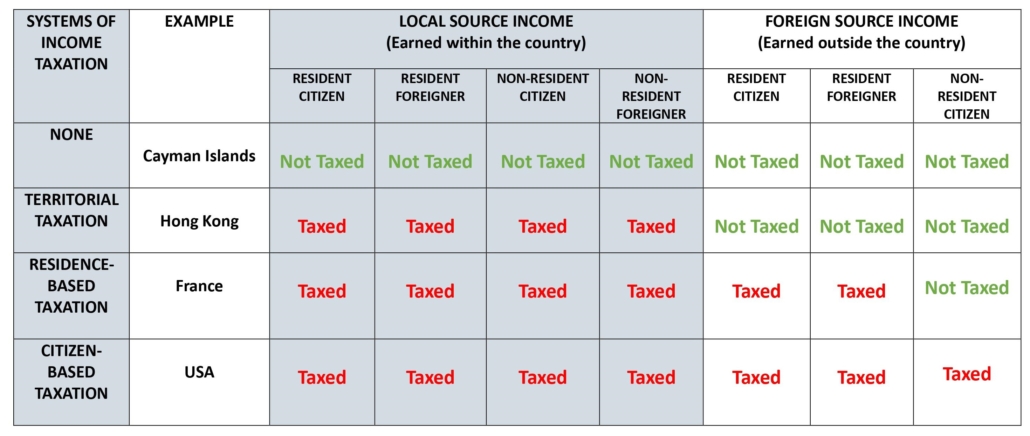

- The United States, unique in the world, taxes its overseas citizens on their non-U.S.-source income.

- The United States should align with the rest of the developed world and switch from ‘citizenship-based taxation’ to ‘residence-based taxation.’

- Residence-based taxation would free overseas Americans from double income taxation and allow them to have normal financial lives in every country where they reside.

- Residence-based taxation would also allow overseas Americans to competitively operate their small, foreign businesses and would reduce the cost for multinational organizations to hire overseas Americans.

- The best way to implement residence-based taxation is for Congress to pass a law amending the Internal Revenue Code to define ‘all United States residents’ as subject to U.S. worldwide taxation and clarify that overseas Americans would only be taxed on local source income generated within the United States.

Overseas Americans have suffered far too long from United States citizenship-based taxation. We should no longer force law-abiding U.S. citizens to renounce their precious American citizenship because of the difficulty complying with draconian tax policies and onerous regulations. We urge the next administration to renounce citizenship-based taxation and adopt residence-based taxation. Free overseas Americans to have normal financial lives and to live their American dream in every country where they reside.” – Solomon Yue, CEO and Vice-Chairman Republicans Overseas Foundation

Below is a chart comparing key forms of income taxation.

JOIN OUR NEWSLETTER

RBT TAX PROPOSAL

NEXT STEPS

Changing America’s income tax policy will be difficult. In order for this to happen, we need to:

- Elect a Republican President and elect Republican majorities in the House and Senate. Democrats are planning to raise taxes if Biden wins in 2024. They will never ‘reduce’ taxes. Only a Republican majority will even consider such a change.

- Encourage Heritage Foundation to include ROF’s white paper on changing from CBT to RBT in their tax policy reform package. Republicans Overseas is engaging with Heritage Foundation on multiple levels to encourage this.

- Share ROF’s white paper with your elected representatives and candidates. Explain the financial difficulties of living abroad to your government officials. You may have already told them this multiple times. Keep at it! And find candidates willing to support these changes.

- Lobby a Republican administration in the White House, the House Ways & Means Committee, and the Senate Finance Committee. ROF will need to fundraise to support these lobbying efforts.

- Continue to petition and lobby your elected representatives. We will need to bring as much political pressure as we can muster.