What is FATCA?

FATCA is the Foreign Account Tax Compliance Act. FATCA was intended to prevent domestic Americans from illegally hiding their taxable wealth in foreign banks, but it has instead created significant hardships for law abiding overseas Americans.

FATCA requires foreign financial institutions (‘FFIs’) such as banks or investment companies to share overseas Americans’ financial data with the IRS. FFIs either sign up with the IRS to send the information directly or share the information with the host countries’ central tax authorities, who then pass it on to the IRS. There is no wealth threshold for the collection of this financial information: if you are an American citizen with an overseas account, then information on that account—no matter the amount of money it contains—will be collected and shared with the IRS. The information collected by the FFIs would require a warrant if gathered on domestic US citizens.

The FFIs collect this information because the US government imposes severe fines upon any FFIs found not to be in compliance. Fines can be up to 30% of all of the FFI’s revenue generated in the United States, which—if imposed—could cripple any financial institution.

To avoid these crippling penalties, banks either diligently comply with FATCA by collecting and sharing their customers’ most sensitive financial information or they choose not to have American citizens as customers at all.

While compliance with FATCA certainly violates Americans’ right to privacy (among others), the most crippling effect is the denial of basic banking services to overseas Americans. These services include checking accounts, savings accounts, retirement accounts, child savings accounts, investment accounts and mortgages. FATCA thus prevents many overseas Americans from participating in the basic financial services needed for everyday life.

Republicans Overseas seeks the repeal of FATCA because FATCA violates several constitutional rights guaranteed to all Americans and because FATCA impedes the ability of overseas Americans to access the financial services necessary for everyday life.

What is FBAR?

FBAR is the Reporting of Foreign Bank Accounts. FBAR is an anti-money laundering regulation dating back to 1970. It was originally devised for the US Department of the Treasury under 31 U.S. Code 5311, in the context of ‘criminal, tax or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, including analysis, to protect against international terrorism.’ FBAR mandates US persons to declare any account outside the US with the FBAR form (TD F 90-22.1).

FBAR assumes that any entity failing to report a foreign account is hiding profits from a criminal activity, and it therefore levies unsustainable civil penalties (up to 50% of total assets for each year of omission), obviously designed to cripple or bankrupt that entity.

In 2003, the US Department of Treasury transferred the administration of FBAR to the IRS, which shifted the focus of FBAR from its original target (white-collar criminals and international terrorists) to the mass of taxpayers, particularly ordinary American expatriates.

In 2008, the reporting threshold was lowered to $10,000 held in aggregate across all foreign accounts. This reduction applied FBAR to middle-class Americans who may already have declared those accounts to the IRS through other means.

With FBAR, not only the account owner is liable to heavy penalties (as described above), but also any ‘person acting for a person as a financial institution, bailee, depository trustee, or agent, or acting in a similar way related to money, credit, securities, gold or a transaction in money, credit, securities, or gold.’ Hence banks, asset managers and attorneys involved with managing overseas Americans’ bank accounts are also liable to full FBAR penalties in addition to the account holder.

FBAR allows the IRS or the US Department of Justice to:

- Force all overseas Americans to surrender their financial data to the IRS who are permitted to share this information with other US government agencies.

- At their sole discretion, select, target, penalize, seize the assets of, agree on onerous ‘settlements’, or else bankrupt any entity that failed to file an FBAR form. This includes those who were not aware of this obligation, including US expatriates, accidental Americans, and any foreign bank, in any country, where any such account was hosted.

(Information and text taken from ‘Notes on FBAR vs. FATCA “FATCA is the Hammer, FBAR is the Anvil”’ by James Bopp, Jr.)

More Frequently Asked Questions

How does FATCA violate constitutional rights?

Republicans Overseas has filed a lawsuit against FATCA claiming eight constitutional violations. These violations are as follows:

- The IGAs (‘inter-governmental agreements’) are unconstitutional Sole Executive Agreements because they exceed the scope of the Presidents’ independent constitutional powers.

- The IGAs are unconstitutional sole executive agreements because they override FATCA.

- The heightened reporting requirements for foreign financial accounts deny U.S. citizens living abroad the equal protection of the law.

- The FATCA FFI penalty is unconstitutional under the Excessive Fines Clause.

- The FATCA Pass-through Penalty is unconstitutional under the Excessive Fines Clause.

- The FBAR Willfulness Penalty is unconstitutional under the Excessive Fines Clause.

- FATCA’s information reporting requirements are unconstitutional under the Fourth Amendment.

- The IGAs’ information reporting requirements are unconstitutional under the Fourth Amendment.

Is FATCA especially harmful for American women living abroad?

According to a study conducted by Democrats Abroad, American women living abroad are frequently collateral damage of FATCA’s implementation. In particular, in order to prevent inadvertently violating FATCA reporting requirements, many stay-at-home mothers are separated from a family’s non-American earned financial assets, which could leave them without property or access to their family’s bank accounts and credit.

Doesn’t FATCA affect mostly super rich people—the so-called ‘Fat Cats’?

No. According to a Democrats Abroad study, FATCA primarily affects middle class overseas Americans:

- 68% of checking accounts closed due to FATCA had balances of less than $10,000.

- 40.4% of savings accounts closed due to FATCA had balances of less than $10,000.

- 69.3% of retirement accounts closed due to FATCA had a balance of less than $50,000.

- 58.9% of investment accounts closed due to FATCA had a balance of less than $50,000.

Does FATCA really affect regular banking services or jobs for overseas Americans?

Yes—FATCA really does affect an overseas American’s ability to access normal banking services or gain certain jobs. According to a Democrats Abroad study:

- 6% of respondents said that they had been denied a position due to FATCA.

- 5% of overseas Americans were unable to open a savings or retirement account.

- Some Mexican banks now refuse to cash checks for American retirees.

Does FATCA affect children, too?

Yes, foreign banks have sent letters to children as young as six months old in order to verify that they are U.S. citizens and to notify them that their financial information will be shared with the IRS.

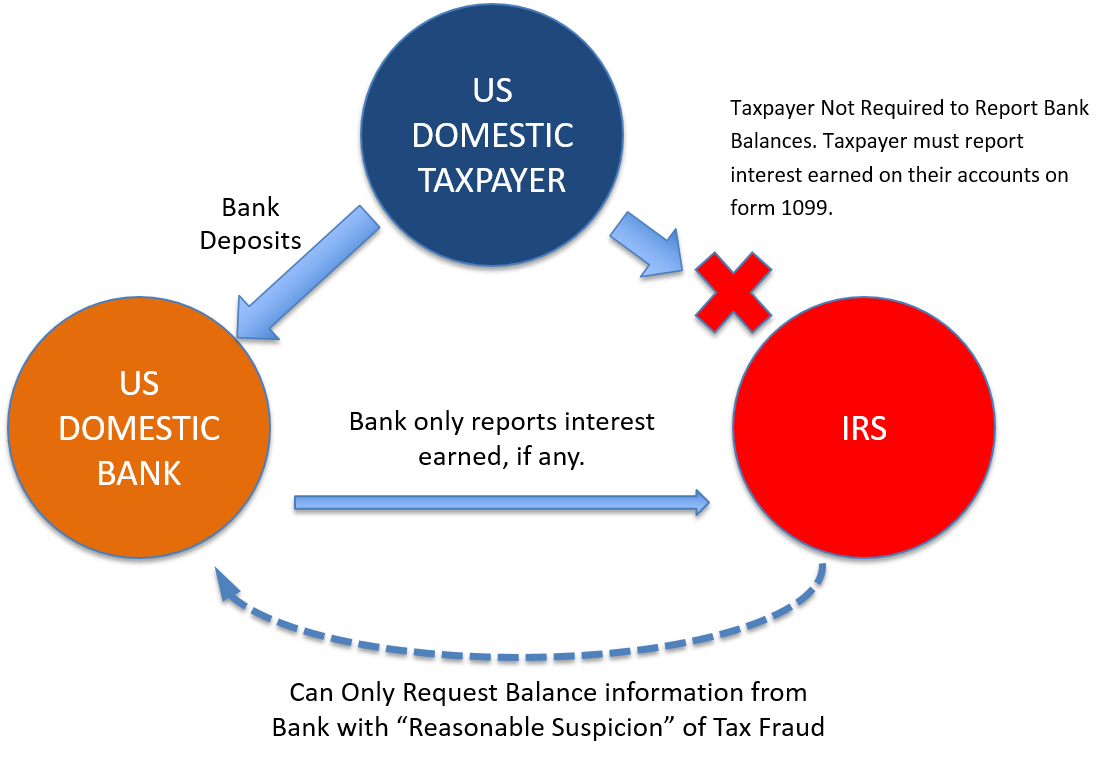

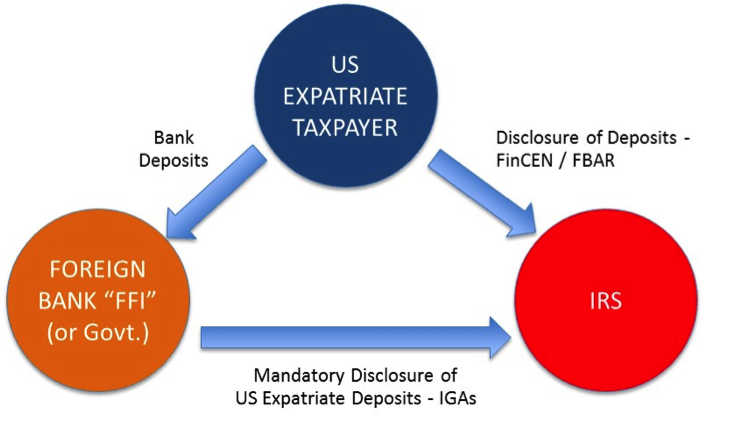

How does the IRS collect overseas Americans’ financial information and how is that different for domestic Americans?

How does the IRS collect overseas Americans’ financial information and how is that different for domestic Americans?

The IRS receives overseas Americans’ financial information through FBAR (Reporting on Foreign Bank Accounts) and FATCA submissions made by American citizens and by FATCA information submitted by FFIs to the IRS either directly or via a country’s central tax authority.

The following diagrams illustrate the differences between American domestic and expatriate taxpayers:

Do individuals have to file FATCA form 8938 (Statement of Specified Foreign Financial Assets) or do only banks have to file?

While banks must file information on all overseas Americans, not all overseas Americans have to file FATCA forms. Some domestic American taxpayers who have overseas accounts must also file FATCA.

See this IRS page for updated details.

Below is the excerpt applying to overseas Americans as of February 2017:

Taxpayers living abroad. You are a taxpayer living abroad if:

◦You are a U.S. citizen whose tax home is in a foreign country and you are either a bona fide resident of a foreign country or countries for an uninterrupted period that includes the entire tax year, or

◦You are a US citizen or resident, who during a period of 12 consecutive months ending in the tax year is physically present in a foreign country or countries at least 330 days.

If you are a taxpayer living abroad you must file if:

- You are filing a return other than a joint return and the total value of your specified foreign assets is more than $200,000 on the last day of the tax year or more than $300,000 at any time during the year; or

- You are filing a joint return and the value of your specified foreign asset is more than $400,000 on the last day of the tax year or more than $600,000 at any time during the year.

Refer to the Form 8938 instructions for information on how to determine the total value of your specified foreign financial assets.

Reporting specified foreign financial assets on other forms filed with the IRS.

If you are required to file a Form 8938 and you have a specified foreign financial asset reported on Form 3520, Form 3520-A, Form 5471, Form 8621, Form 8865, or Form 8891, you do not need to report the asset on Form 8938. However, you must identify on Part IV of your Form 8938 which and how many of these form(s) report the specified foreign financial assets.

Even if a specified foreign financial asset is reported on a form listed above, you must still include the value of the asset in determining whether the aggregate value of your specified foreign financial assets is more than the reporting threshold that applies to you.

What are the penalties for individuals who fail to file the FATCA or FBAR forms?

Excessive penalties are levied on overseas Americans who fail to file FATCA or FBAR forms. To be clear, these penalties are not for unpaid taxes: they are for failing to file a report.

The penalty for failure to file the FATCA form is $10,000. If the form is not filed within 90 days after notification by the IRS, an additional penalty of $10,000 per month is levied, up to a total of $60,000. Criminal penalties may also apply.

The penalty for failure to file the FBAR form is up to $10,000 for a non-willful failure to file. For a willful failure to file FBAR, the annual penalty is the greater of $100,000 or 50% of the account balance. Criminal penalties may also apply.

What is an accidental American and how does FATCA affect them?

Accidental Americans are persons who were born in a foreign country to American parents (even if they have never resided in the U.S.), persons born in the U.S. to foreign parents who have never lived in the U.S., and the foreign spouses of Americans.

FATCA applies to all accidental Americans, even if they have never resided in America or applied for an American passport.

Does FATCA impact American green card holders and other immigrants to the US?

Green Card holders and other immigrants in the U.S. generally maintain bank accounts outside of the United States for various legitimate reasons, and they are subject to the same unreasonable privacy intrusions and risk of unfair penalties as overseas Americans. The FATCA filing thresholds for domestic Americans is lower than that for overseas Americans. See this IRS page for details.

Does FATCA impact domestic Americans?

Yes. If domestic Americans have overseas bank accounts, then they are subject to FATCA. See this IRS page for details. If FATCA is not repealed, and if OECD is successful in its push for a global FATCA requiring sharing of financial information among all countries, then all 320 million US Citizens will have their privacy violated.

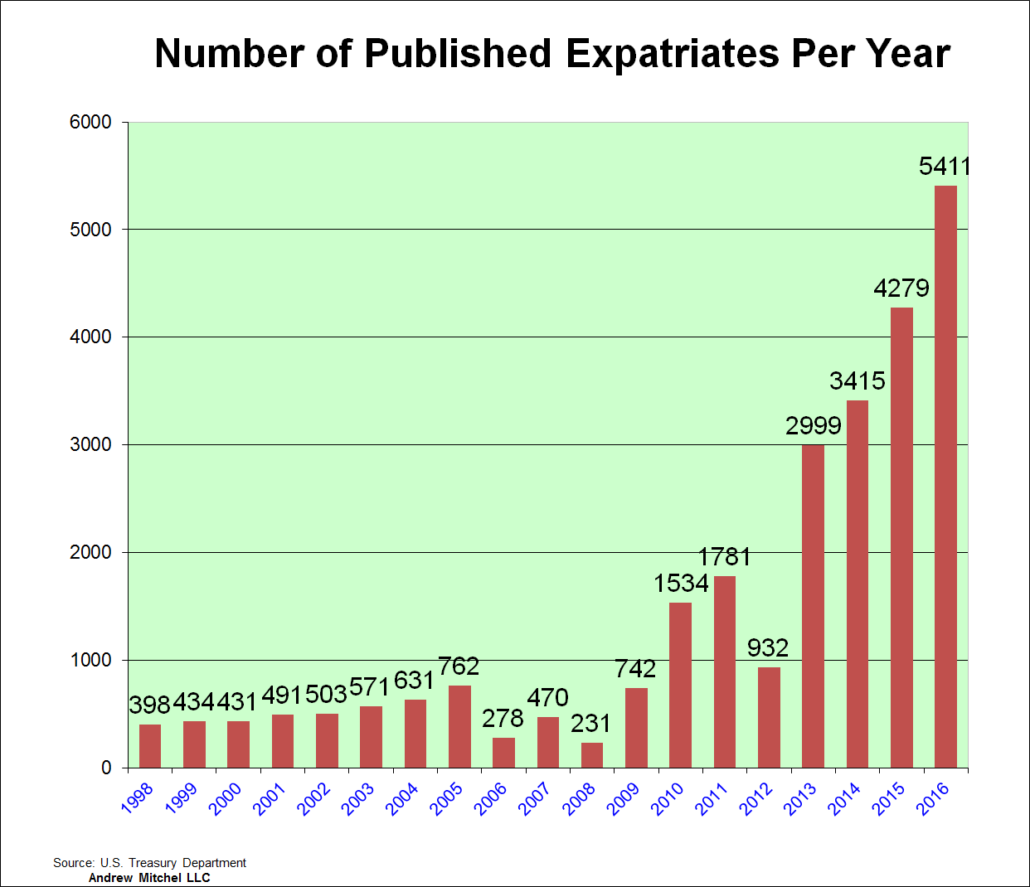

Are FATCA and FBAR driving American citizenship renunciations?

Yes. Many overseas Americans who have made their lives in foreign countries are unable to obtain bank accounts for personal or business reasons, which makes their life untenable. Most people who renounce their American citizenship do so very reluctantly and only after they are driven to it by American taxation and reporting requirements. Since FATCA took effect and banking institutions around the world began denying Americans overseas banking services, renunciations have skyrocketed to historic levels, as shown in the chart below from Andrew Mitchel LLC and its International Tax Blog.

Source: U.S. Treasury Department via Andrew Mitchel LLC

When was FATCA passed into law and when did it go into effect?

FATCA is Article V of HR2847 Hiring Incentives to Restore Employment (HIRE).

The original legislation was passed by the House in June 2009 and in the Senate in November 2009. Amended versions were passed by the House and Senate between December 2009 and February 2010. No Republican House members voted for FATCA. Only 11 Republican Senate members voted for FATCA, and six of them are still in office today.

FATCA was inserted by committee as a Pay-As-You-Go provision into the HIRE legislation just prior to the final vote; it was never reviewed or voted on separately by any member of the House or Senate.

The HIRE act (including FATCA) was signed into law by President Obama on March 18, 2010.

FATCA took effect on July 1, 2014.

Won’t the Same Country Safe Harbor act ‘fix’ FATCA?

No. The Same Country Safe Harbor (SCSH) would continue to permit the IRS to collect financial data on overseas Americans with bank accounts in more than one country. The SCSH would continue to deprive overseas Americans of their right to privacy and to violate the Equal Protection Clause. Under SCSH, the IRS could collect information on the financial assets of those overseas Americans with accounts in more than one country but could not collect the same information from either domestic U.S. citizens or from overseas Americans with accounts in only one country.

Moreover, SCSH is based on the faulty assumption that overseas banks will be comfortable policing whether Americans with overseas bank accounts continue to reside in the same country. Most likely, overseas banks will continue to deny all Americans financial services (or continue to enforce FATCA against all Americans) rather than risk an accidental violation of FATCA that could result in a crippling 30% penalty.

SCSH does not fix FATCA: FATCA cannot be fixed. It must be repealed.

FATCA UPDATES

Stay Connected!

Receive periodic updates, news alerts, and information impacting the expat community.

Paid for by Republicans Overseas Action, Inc. Not authorized by any candidate or candidate committee.