French Senator for French Abroad agrees to support TFFAAA

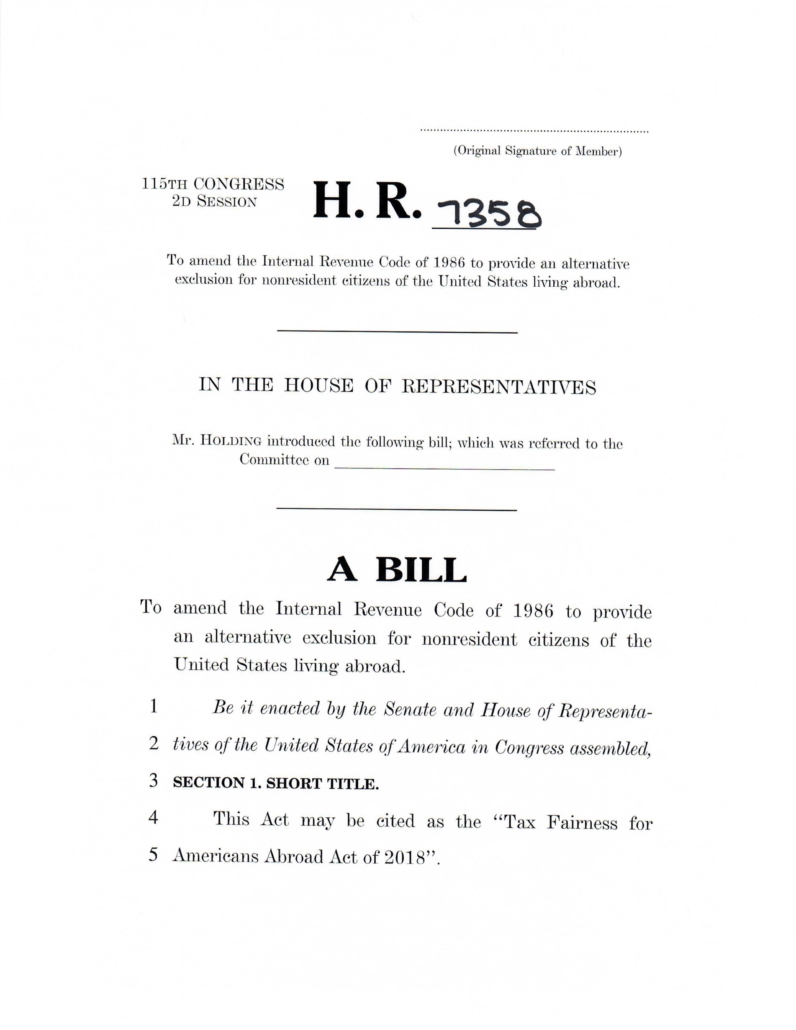

Damien Regnard, French Senator representing French Abroad will not only support the Tax Fairness For Americans Abroad of 2018 (H.R. 7358), but also lobby members of U.S. Congress from both sides of the aisle next week to make TTFI a reality for his dual citizens and Accidental Americans.

Republicans Overseas France Chairman Marc Porter (left), Republicans Overseas Vice Chairman and CEO Solomon Yue (middle), French Senator Damien Regnard (right) at the French Senate chamber on Sept. 21, 2018.