Republicans Overseas Foundation submits residence-based income tax proposal for the next administration’s tax reform package

Salem, OR: On March 28, 2024, the Republicans Overseas Foundation submitted a residence-based tax proposal to Heritage Foundation’s Project 2025 for potential inclusion in the next administration’s tax reform package. The proposal, titled ‘Ending the Unjust Taxation of Overseas Americans,’ provides three actionable recommendations, including the preferred legislative solution of completely severing citizenship from United States income tax policy.

Unique among nations, the United States taxes its non-resident overseas citizens on their non-U.S. source income. This is citizenship-based taxation (‘CBT’). While the Foreign Earned Income Exclusion (‘FEIE’) may partially offset the taxation of employment income earned overseas, FEIE does not offset other sources of foreign-earned income, such as pensions. CBT often leads to the double taxation of overseas Americans who are already paying income taxes in their country of residence. CBT combines with regulations such as the Foreign Account Tax Compliance Act to prevent overseas Americans from fully engaging in the normal financial and retirement planning activities necessary for their families. These unjust income tax policies and regulations are driving the increased rate of American citizenship renunciation.

“Overseas Americans have suffered far too long from United States citizenship-based taxation. We should no longer force law-abiding U.S. citizens to renounce their precious American citizenship because of the difficulty complying with draconian tax policies and onerous regulations. We urge the next administration to renounce citizenship-based taxation and adopt residence-based taxation. Free overseas Americans to have normal financial lives and to live their American dream in every country where they reside.” – Solomon Yue, CEO and Vice-Chairman Republicans Overseas Foundation.

We urge Americans to read the proposal and forward it to your Congressional representatives and candidates. Ask them to support tax fairness for overseas Americans.

Republicans Overseas Foundation is the 501(c)(3) entity within the Republican Overseas organization. The Republicans Overseas Foundation seeks equal tax treatment for stateside and overseas Americans. Paid for by the Republicans Overseas Foundation. Not authorized by any candidate or candidate’s committee. Contributions to the Republicans Overseas Foundation are tax deductible for federal income tax purposes.

Read the News Release here.

Find out more at Republican Overseas’ RBT page.

RO Tax Talk Episode 2: What is pure RBT?

Please join us as we chat about the severe impacts of the United States’ citizenship-based taxation on overseas Americans and why pure RBT is the answer.

RO Tax Talk Episode 1: The Need for Pure RBT

Please join John Richardson, Jim Gosart, and Kym Kettler-Paddock as we talk about every overseas American’s least favorite thing: citizenship-based taxation.

Hint: we want to get rid of it! Bring on pure Residence Based Taxation.

Join us each week for a snippet of RO Tax Talk.

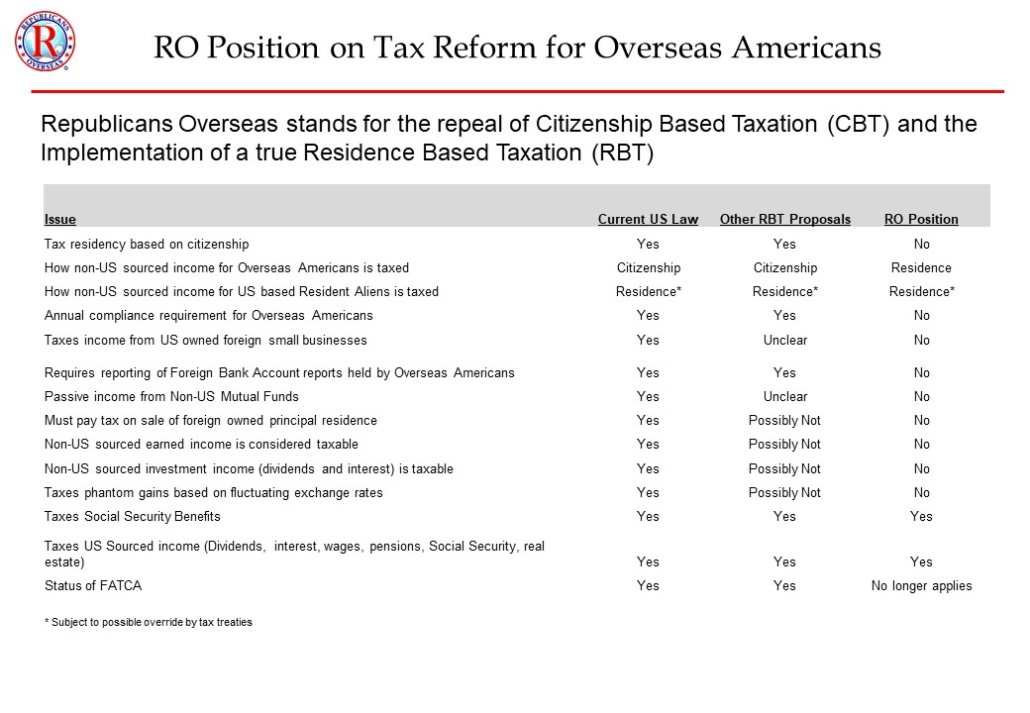

Pure RBT is the only real solution for Overseas Americans

Republicans Overseas stands for the full repeal of Citizenship Based Taxation and for the implementation of pure Residence Based Taxation. See below for a summary of our position.