Not sure what the GILTI tax is and why Monte Silver’s successful lawsuit is such a win for overseas American business owners? Then please read on as Monte has kindly explained what GILTI is and how it impacted overseas Americans:

Yesterday, Treasury issued the final regulation related to GILTI and the 50% GILTI-related deduction. The final regulation included 3 !!! significant and permanent wins for our advocacy!

1. The IRC 250 deduction is formally available to a taxpayer doing a 962 election.

2. The 962 election is retroactive to 2018, the first year that GILTI applied (new, not in the proposed regulations)

3. A company can make a 962 election in an amended return (new, not in the proposed regulations)

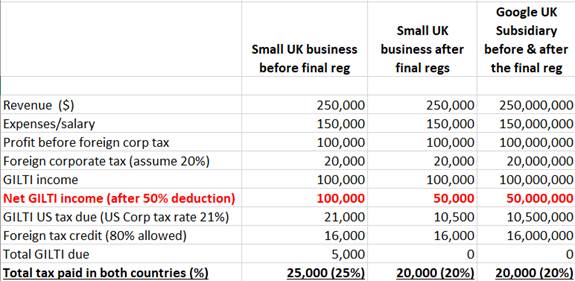

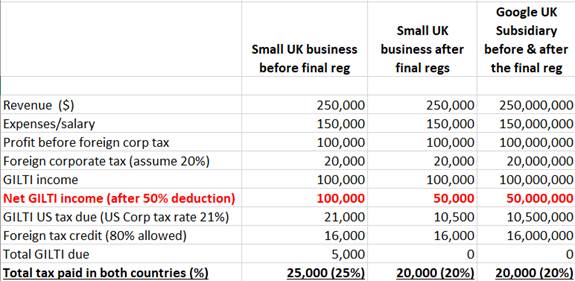

This is really dense stuff, so let me explain and provide a numerical example:

GILTI is a tax that was created in the Tax Cuts & Job Act. Its goal was justifiably to prevent Apple, Google and similar corporate Goliaths from abusively shifting profits from the US to low tax countries like Cayman Islands. To accomplish this, GILTI imposed a US tax on the US parent company for the annual profits of its foreign subsidiaries. The way that GILTI was structured is that GILTI tax would be due where the subsidiary was located in countries where the local corporate tax was less than 13.125%.

Unfortunately, the law caught about 200,000 small businesses in the same net. To make matters worse, until the final regulation was issued, small businesses paid higher GILTI tax rates than the corporate Goliaths. The numerical example below should help understand the problem and the relief. Until now, only the corporate Goliaths got the 50% deduction (in red below). Before the final regs (the numerical column on the left), a small business owner did not. As a result, not only did small businesses incur huge GILTI-related compliance costs, but at the end of the day they paid a higher tax rate than the Goliaths (25% compared to 20). Insane.

Under the permanent regulation (center numerical column), the playing field has been leveled. We and the corporate Goliaths are treated the same, and as long the corporation is incorporated in a country where the corporate tax rate we pay is at least 13.125%, then we will not own any GILTI.

In addition to the core relief, the permanent regulation also applies retroactively to 2018, and we can amend our 2018 return to take advantage of this benefit, to the extent we did not.

This is a major win. Small businesses are invisible to the federal government. And the fact that we accomplished this and other forms are relief from the Transition tax and GILTI is a testament to our combined voice and focused persistence.

This relief in no way makes the GILTI lawsuit moot. The GILTI lawsuit seeks to have small businesses 100% exempt from the GILTI tax – i.e. no need to comply each year, regardless of the tax rate of the country in which the corporation is incorporated.

To see the regulation, click here: https://www.silvercolaw.com/…/final-gilti-related-regulatio…