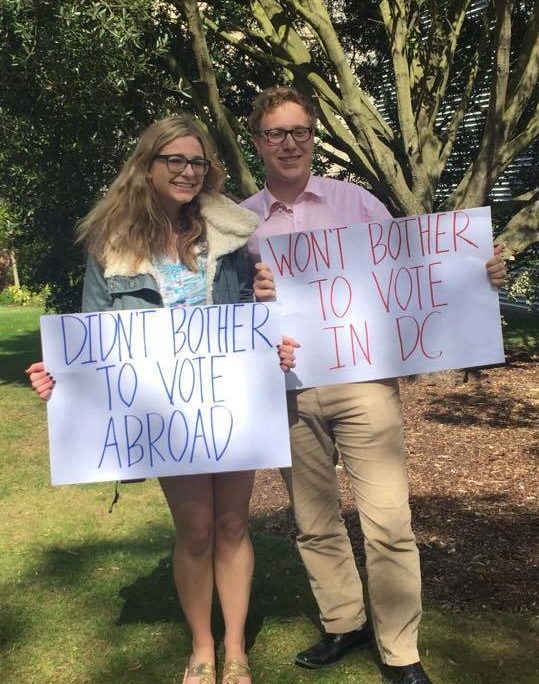

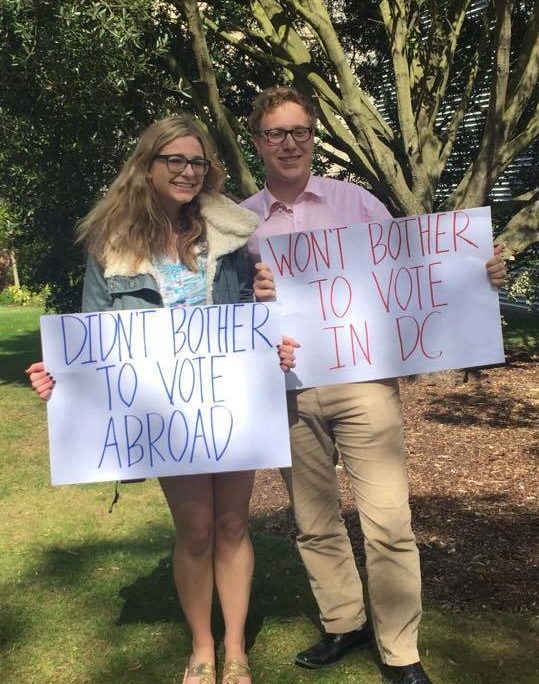

Drew Liquerman, Chairman of Republicans Overseas UK, St Andrews Chapter, organized some American students studying at the University of St Andrews to hold up signs asking why Jon Ossoff did not vote when he was studying in the UK.

OPEN LETTER TO JON OSSOFF

Mr. Ossoff, the citizens of Georgia’s 6th district ought to know about your disqualifying record of voting and congressional carpet bagging. We can talk about the fact you live outside of GA06 and as a result cannot vote for yourself but what I would like to know is why you failed to exercise your most basic right and duty of a US citizen in the 2012 election.

It has recently been revealed that you did not vote in the 2012 election because you were studying abroad in London. Well Mr. Ossoff, inconvenience is no reason to not vote. I am currently studying at the University of St Andrews and made sure I casted a vote to make myself heard in the 2016 election as did most members of the Republicans Overseas St Andrews chapter. You were eligible to partake in the 2012 election but you choose not to because you did not care enough

If you can’t take the time to cast your vote how can the constituents of Georgia’s 6th district – a district you do not even live in, trust you to vote in their interest and represent them in Washington DC?

The residents of Georgia’s 6th district deserve someone to represent them who is willing to partake in democracy as well represent and actually live in the district they wish to represent.

I know you cannot vote for yourself in your upcoming election, but should you find yourself living abroad again – here is how you can vote.

https://www.fvap.gov/georgia

Drew Liquerman

Chairman, Republicans Overseas UK, St Andrews Chapter