US expats given hope of lower tax bills

Republicans edge towards eliminating need to pay levies overseas and at home

Millions of US citizens working overseas could see their tax bills lowered by an overhaul of the tax system as Republicans edge towards eliminating a requirement for American expatriates to pay taxes both overseas and in the US.

Kevin Brady, the Republican head of the House ways and means committee, which is drafting a tax reform bill, said lawmakers were considering the measure, which has been the focus of lobbying by Republicans Overseas, a group of party donors around the world.

“It is under consideration. They have made the case,” Mr Brady said in response to a question from the Financial Times at a Christian Science Monitor breakfast. “Lawmakers representing that area of the tax code have made that case.”

Some 8.7m Americans live outside the US, excluding military personnel, according to the Association of Americans Resident Overseas.

For those expatriates, the first portion of their foreign earnings — about $100,000 in 2016 — is already shielded from US tax liabilities, but they have to pay tax on any income above that level to both the host authority and the US. The mooted change would therefore benefit those on six-figure salaries.

Republicans are striving to pass the first major overhaul of the US tax code since Ronald Reagan in 1986. They are looking at measures that would simplify the code, lower the corporate tax rate, make it less attractive for US companies to keep cash overseas, and changes that they say will help the middle class.

Mr Brady later told the FT that lawmakers were taking “seriously” the call for a shift from a citizen-based income tax system to a residence-based system that would only tax people on the income they earn in the US.

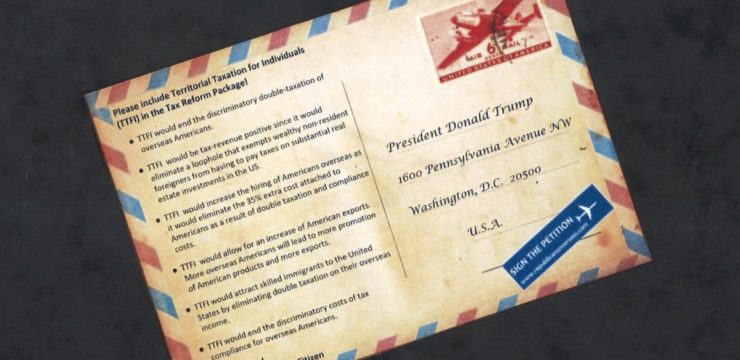

Republicans have already decided they want to make an equivalent change for business, switching to a “territorial” regime where most of US companies’ foreign earnings are beyond the reach of American tax collectors.

The US Chamber of Commerce, a business lobby group, has urged policymakers to consider US-only taxation for individuals, too, arguing that taxing foreign income hurts American managers at the overseas affiliates of US exporters.

In a recent interview with the FT, Mick Mulvaney, the White House budget office director, said he supported the shift to residence-based taxation. “It is something that I have advocated for as a member of Congress,” Mr Mulvaney said. “It is good for American businesses to encourage Americans to work overseas.”

Solomon Yue, vice-chairman of Republicans Overseas, this week submitted a petition with 3,027 signatures calling for the change to Shahira Knight, the White House official in charge of tax policy, and also to Mr Brady’s staff on the House ways and means committee. “We made inroads with his [Brady’s] chief of staff yesterday when we presented the signatures,” Mr Solomon said.

Michael DeSombre, an American partner at the law firm of Sullivan & Cromwell in Hong Kong who chairs Republicans Overseas, said the White House was also supportive. “The White House and the Republican National Committee support the proposal but are not going to push for it actively.”

James Brandell, a lobbyist helping the Republicans make their case, said Ms Knight said the White House “sees no policy problem” with the proposal, but urged them to focus on the House ways and means committee and the Senate finance committee which are writing the tax bill.

The White House acknowledged that Ms Knight had met with the Republicans Overseas team, but Raj Shah, deputy press secretary, said their account of the meeting was “not accurate”.

Caroline Harris, a US Chamber tax official, told Congress in a letter in July that taxing individuals’ foreign income “significantly undermines the global competitiveness of US exporters. No other country taxes its citizens working abroad, and any transition to a territorial tax system should take this into consideration and end this damaging practice.”

Mark Mazur, who was the top tax official in Barack Obama’s Treasury department, said he supported the change, arguing that it was necessary to address the “inequity” of an expat paying tax on the same income to both the US and a foreign government.

“If you take two people, one works in London, one in New York, working for the exact same US multinational — if they make the exact same amount of money you might think they should be taxed exactly the same,” said Mr Mazur, who heads the Tax Policy Center.

The US has tax treaties with more than 60 countries that to varying degrees reduce, but do not usually eliminate, the US tax burden on American expatriates.

Follow Demetri Sevastopulo and Barney Jopson on Twitter:

@dimi

@barneyjopson

https://www.ft.com/content/4909d804-b9a1-11e7-8c12-5661783e5589